Auto Insurance industry's collision with driverless carsIntroduction

Driverless cars an innovation and milestone in auto-

industry

eOne car -solution to many problems such as

casualties, traffic crashes, traffic jams, parking space

o US auto-insurance model

Liability

Who will be liable:

Owner or manufacturer?

. Complexity in deciding liability:

Technical fault auto-manufacturer

External factor car owner/Insurer

e Manufacturer Insurer and Insured!

May provide limited insurance agent

May need to get insured to cover risk of bulk-produced faulty

applications

Underwriting and pricing

Ri5K ?

Driving record

It will be obsolete, but may be replaced by system credibility of

driverless car the personal insurance

The type, make and model of car

Premium will be high as car will be expensive

. Type and amount of coverage

Risk of damage/theft is more, risk of accidents is less

Obsolete factors - age, gender

. Car will be insured, not the car-owner!

Claims

CLAIM FORM

. Industry is fueled by claims

Major accidents - one every 14 sec

Fatal crashon

. Largest non-life insurance groups

sector

But picture is changing...

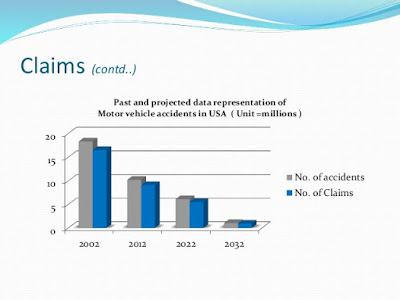

Claims (contd..)

In past 10 years, net premiums are down by 7%

In next two decades-claims may reduce by 90 %

nature of claims will change

e Claims fraud will be eliminated due to availability of

huge data related to every single motion of cars

involved insurance broker

e Claims inflation will stagnate

. Role of claims handlers and adjusters will change

Profitability

- Premiums o Frequency, severity of accidents

- e Reduce net premiums means less revenue

- . Shrinkage of industry: s200 Billion

- s20 Billion

- However, few experts claim that due to increased

- severity and cost to fix cars, business will be more

- profitable

Strategy

- Insure need to make strategic choices

- due to lack of actuarial premium data

- Few insurers will delay price-reduction and enjoy

- short-term profit

- , focused on transition, will reduce prices,

- steal the best customers and gain market share

- Strategy is the key point to survive the impact of

- driverless cars!

Conclusion

Significant role of manufacturers in

insurance policy

processes will be car-centrid

Much like home insurance Claims rare ,but high

. Challenges for auto-insurers - maintain profit margin,

decide the right strategy

إرسال تعليق